Discharge of Charge and Deed of Receipt and Reassignment in Malaysia: A Comprehensive Guide

Introduction

In the realm of property ownership and financing, ensuring proper legal documentation is vital for protecting the rights of both borrowers and lenders. Two key legal documents – Discharge of Charge and Deed of Receipt and Reassignment are integral to confirming the release of the lender’s interest in the property and ensuring the borrower regains full ownership. These documents not only formalize the end of the financial obligation but also clear the borrower’s title, removing any encumbrances tied to the property.

In this article, we will explore the purpose and importance of both the Discharge of Charge and the Deed of Receipt and Reassignment, highlighting the differences between them and providing a step-to-step guide on how to apply for each. Understanding how this process works is essential for both borrowers and lenders to ensure protection of property rights and avoid complications in future transactions.

What is a Charge?

A charge is a legal mechanism where the borrower’s property is used as a security for a loan or financial obligation. In Malaysia, charges are commonly created over real estate, such as land or buildings, to secure loan repayment. The charge gives the lender (the chargee) a legal right to the property should the borrower (the chargor) fail to fulfil their financial obligations.

Charges are commonly used by financial institutions, such as banks, to secure mortgages or other forms of credit.

What is a Discharge of Charge?

The Discharge of Charge is a legal document that removes the lender’s interest in a property after the borrower has fully repaid their loan. The Discharge of Charge confirms that the borrower now has full and unencumbered ownership of the property, free from the lender’s claim.

With the Discharge of Charge, the borrower regains complete control over the property and can sell, transfer, or deal with it without any restrictions tied to the lender.

Why is a Discharge of Charge Important?

- Retrieving the Original Issue Document of Title: Once the Discharge of Charge is complete, the borrower can reclaim the Original Issue Document of Title from the lender.

- Clearing the Property Title: The process ensures that borrower’s title is free from any encumbrances, meaning the lender has no further legal claims to the property.

- Legal Protection to the Borrower: It ensures that the borrower is no longer liable for the debt and that the lender’s right to the property are formally terminated.

- Facilitating Property Transactions: If the borrower wishes to sell or transfer the property, the Discharge of Charge is necessary for the transaction to proceed smoothly without delays or legal complications.

- Avoiding Legal Disputes: It provides legal certainty and prevents future ownership disputes.

How to Apply for a Discharge of Charge?

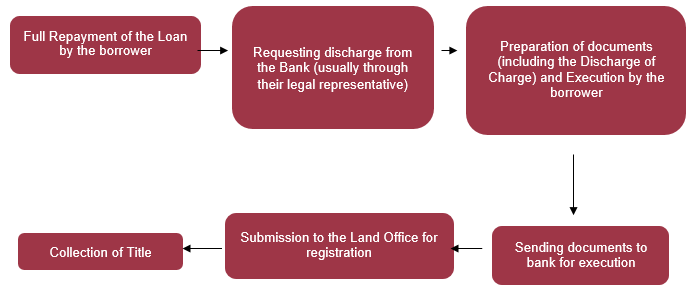

The process for obtaining a Discharge of Charge typically involves the following steps:

The entire process of obtaining the Discharge of Charge typically takes around 2 months, depending on the efficiency of the bank and the land office in processing the documents.

What is a Deed of Receipt and Reassignment?

A Deed of Receipt and Reassignment is a legal document used to confirm the full repayment of a loan and the subsequent release and reassignment of the lender’s interest in the property. This deed is particularly applicable when the lender holds a deed of assignment as security for the loan. While it serves similar purpose to the Discharge of Charge, the Deed of Receipt and Reassignment is used when the individual issue document of title for the property has not yet been issued by the relevant authorities.

In simpler terms, the Deed of Receipt and Reassignment formalizes the lender’s release of any claim over the property, allowing the borrower to regain full rights to the property after settling the loan in full.

How to Apply for a Deed of Receipt and Reassignment?

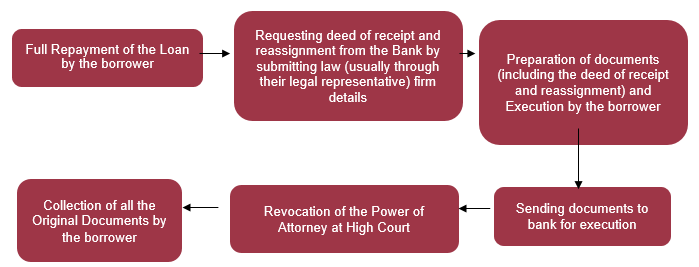

The process for obtaining a Deed of Receipt and Reassignment typically involves the following steps:

The entire process generally takes around 2 months, depending on the processing times of the bank and the land office.

Special Note

It is crucial to retain all original documents until the Individual Issue Document of Title is registered in the owner’s name. This ensures a complete chain of ownership and protects the borrower’s legal rights to the property.

Conclusion

Both the Discharge of Charge and the Deed of Receipt and Reassignment are essential legal documents in Malaysia for securing property ownership rights upon loan repayment. They ensure that once a loan is fully settled, the borrower’s title to the property is free from any encumbrances, and the lender’s rights are formally relinquished.

For borrowers navigating these processes, it is advisable to consult a legal professional to guide you through the necessary steps and ensure that all documents are properly executed and registered to safeguard your property rights and facilitating seamless transactions.

If you have any questions or require any additional information, please contact our lawyer that you usually deal with.