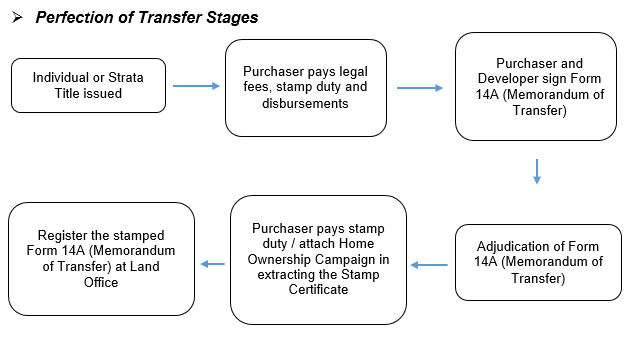

PERFECTION OF TRANSFER (POT)

What is a POT? It basically is a process of perfecting or registering the separate title to a property i.e. the duly issued Individual or Strata Title by the relevant authority under the name of a property purchaser. This circumstance usually occurs when the property is previously purchased on without title basis and that the property is still undergoing its stages of construction be it a landed housing development or a high-rise building whereby the developer or the proprietor owns the plot of the land and the entire housing development project is held under a Master Title. In other words, the entire housing development project remains under the particular Master Title until it is sub-divided into individual lots and registered under the name of the property purchasers. Therefore, the developer shall make necessary applications to ensure that the Individual or Strata Title is issued. Upon issuance of the Individual or Strata Title, the developer shall inform the purchasers and all respective purchasers are strongly advised to engage solicitors as soonest possible to assist them in perfecting the titles in favour of them respectively.

How much should a purchaser pays for stamp duty?

Stamp duty payable is depending on the purchase price of the property at the time of signing of Sale and Purchase Agreement (SPA) with the developer.

The scale rates for stamp duty imposed under the Stamp Act 1949 are as follows: –

| Purchase Prices Rates | Rates |

|---|---|

| First RM 100,000 | 1% |

| Next RM 400,000 | 2% |

| Next RM 500,000 | 3% |

| Above RM 1,000,000 | 4% |

Example of stamp duty calculation:-

Sale and Purchase Price: RM 1,500,000.00

First RM 100,000.00 = RM 1,000.00

Next RM 400,000 = RM 8,000.00

Next RM 500,000 = RM 15,000.00

Balance in excess of RM 500,000 = RM 20,000.00

Total stamp duty payable: RM 44,000.00

Documents required for POT:-

- A copy of the purchaser’s Identity Card;

- A copy of the Title Deed;

- A copy of the Sale and Purchase Agreement;

- A copy of the latest Assessment Receipt;

- A copy of the latest Quit / Parcel Rent Receipt;

- A copy of the Blanket Consent (Transfer) (if applicable); and

- Other relevant documents required by the Developer.

If you have any questions or require any additional information, please contact our lawyer that you usually deal with.

This article is written by

Gwen Yeap Siew Fen

Partner, Low & Partners

Neoh Soon Pei

Legal Associate, Low & Partners

Related Articles

Land Title Conversion in Sarawak

Rights Over the NCR Land

Understanding Legal Due Diligence in Real Estate Transactions in Malaysia: A Comprehensive Guide for Buyers and Sellers

A Management Corporation Imposing Different Rates of Maintenance and Sinking Fund Charges (‘Charges’) In A Strata Property- Yes or No?

Questions? We're here to help