Real Property Gains Tax (RPGT) Calculation For A Deceased’s Property

1. By Way of Transfer & Transmission

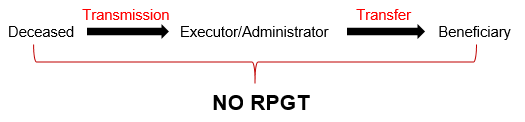

• Transmission between Deceased to Executor/Administrator and the transfer between Executor/Administrator to the Beneficiary is deemed no loss or gain.

• In this event, no RPGT will be imposed.

2. Transfer of Deceased’s Property in Sub-sales Situation

• Transfer of Deceased’s property in sub-sales situation is depending on 2 factors:-

![]()

(a) By Way of Sale (Title registered under Beneficiary’s name)

| (i) Date of Acquisition | The date when the property being transferred to the Beneficiary |

| (ii) Acquisition Price | The date when the property being transferred to the Beneficiary |

(b) By Way of Sale (Title already transmitted into the Executor’s name) via Court Order for Sale

| (i) Date of Acquisition | The date of death of the Deceased |

| (ii) Acquisition Price | The value of the property when the Deceased passed away |

If you have any questions or require any additional information, please contact our lawyer that you usually deal with.

This article is written by

Yeo Soo Peng

Partner, Low & Partners

Chloe Yong Chi Yhin

Legal Associate, Low & Partners

Share this article

Land Title Conversion in Sarawak

Q: What is Land Title Conversion? A: In Sarawak, land titles are categorized by their use such as agriculture, commercial, or residential. If you want to change how you use your land (like converting agricultural...

Rights Over the NCR Land

Native Customary Rights (NCR) land disputes are a common issue in Sarawak and Sabah. For many local communities, NCR land is not just property but a part of their heritage, livelihood, and identity. Unfortunately, disagreements...

Understanding Legal Due Diligence in Real Estate Transactions in Malaysia: A Comprehensive Guide for Buyers and Sellers

Real estate transactions in Malaysia, whether you’re buying your first home, investing in commercial property, or selling a family asset are often significant financial commitments. These transactions, while exciting, are also fraught with potential legal...

A Management Corporation Imposing Different Rates of Maintenance and Sinking Fund Charges (‘Charges’) In A Strata Property- Yes or No?

INTRODUCTION The Strata Management Act 2013 in Malaysia governs the management and upkeep of stratified residential properties. It aims to ensure that these properties are well-managed, and that residents, developers, and landowners have their rights...